Published on: 03/20/2020 • 6 min read

Avidian Report – Focus on Things That You Can Control

INSIDE THIS EDITION:

Focus on Things That You Can Control

KHOU Interview – “How to protect investments amid coronavirus uncertainty on Wall Street“

Avidian Wealth Recession Survival Guide

401k Plan Manager

[toggle title=’Read More’]

In markets, security prices reflect the discounted value of future cash flows. So what happens, when those cash flows cannot be forecasted due to tremendous uncertainty? The answer is that we get huge volatility to both the upside and the downside like we have seen for the last month, as investors try to forecast cash flows considering an impossibly uncertain future. That is in essence where we are today as investors grapple with the uncertainty of the economic impact and duration of the Coronavirus.

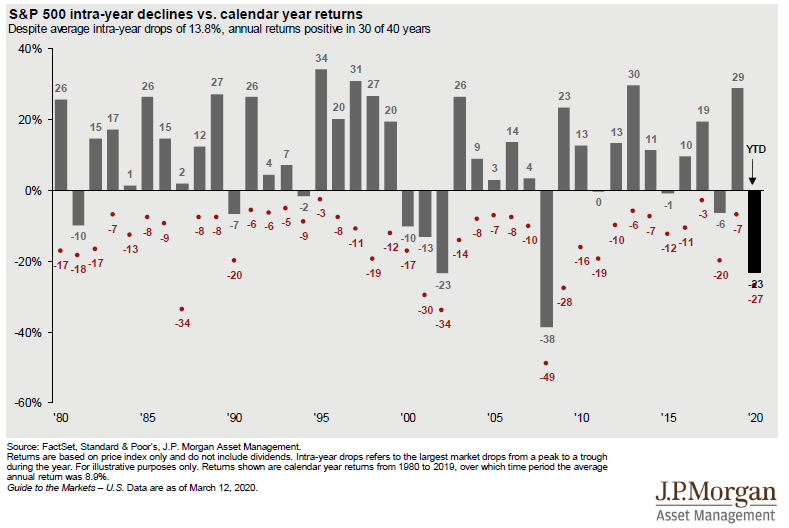

This is not the first time we have faced periods of heightened uncertainty. Over the last 40 years, we have had other viruses, wars, presidential elections, economic recessions, and economic shocks to introduce a wide range of possible outcomes. Looking back over the last 40 years, the S&P has experienced an average intra-year drop of 13.8%. Despite that, annual returns have been positive in those years 30 out of the 40 years, or 75% of the time. In the 1980s in fact, we had one year which saw an intra-year decline of 34%, only to close the year up by 2%.

While it would be fantastic to tell investors that this year will be similar to that, we, unfortunately, cannot predict with that level of certainty. That is why, rather than spending time and energy focusing on the things we cannot control, we encourage investors to focus more keenly on those handfuls of things they can control. In this week’s newsletter, we will focus on three of the things that investors should keep in mind and do as we collectively navigate the primary and secondary impacts of the Coronavirus on the world and its economy.

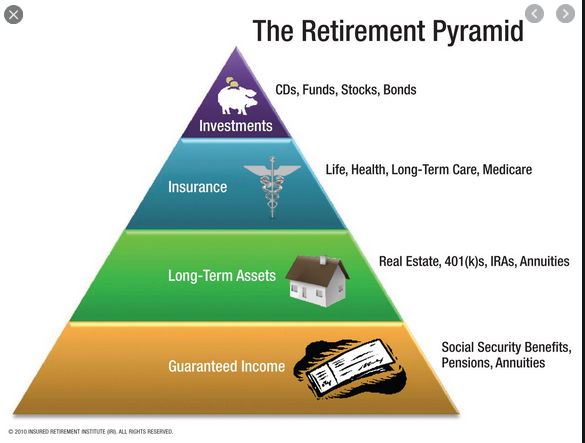

Item 1: Bucket approach to investing

Investing can be thought of through the lens of buckets of money. We encourage investors to do this because it can help control emotions in a volatile market environment. For example, an investor might break their assets into three “buckets”. Bucket one would be earmarked to meet short-term goals. This includes money that makes up part of an emergency fund that might cover all spending needs for a period of time if something unforeseen happens – like a job loss. Typically knowing how many months of living expenses you want in your emergency can be both controlled and a starting point. Bucket two would serve to fill an investor’s medium-term goals. These are goals that are meant to be realized over a longer time horizon, perhaps 5-10 years for example. These assets might include some fixed income and would be set aside to fund home purchases or paying college tuition. Bucket three contains the assets that serve longer-term needs and goals. This might be money that would not be touched for more than 10 years – like retirement assets. In this last bucket, you might have a mix of bonds and risky assets, like stocks, which might have shorter-term volatility but offer higher return potential over the long-term.

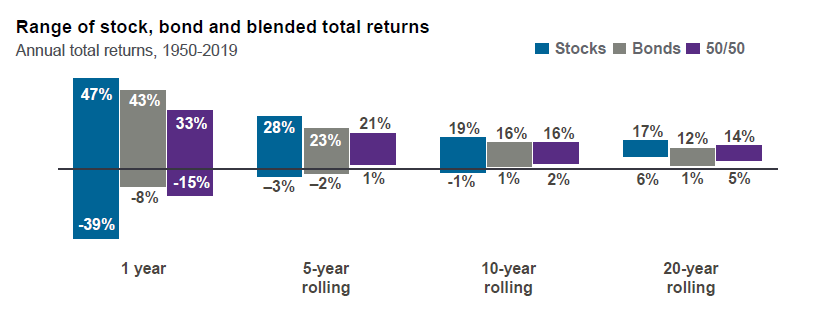

By taking a bucket approach, an investor controls how they might feel in a drawdown. Knowing that short-term obligations can be met with cash and equivalents in bucket one, may let an investor sleep well at night even in the face of short-term volatility as the portfolio has an opportunity to rebound. The chart that follows shows the range of stock, bond and total returns for a blended portfolio. What we find is that historically if an investor gives his/her investment time, the likelihood of producing a loss diminishes greatly.

Item 2: Know the current levels of income being generated by your portfolio

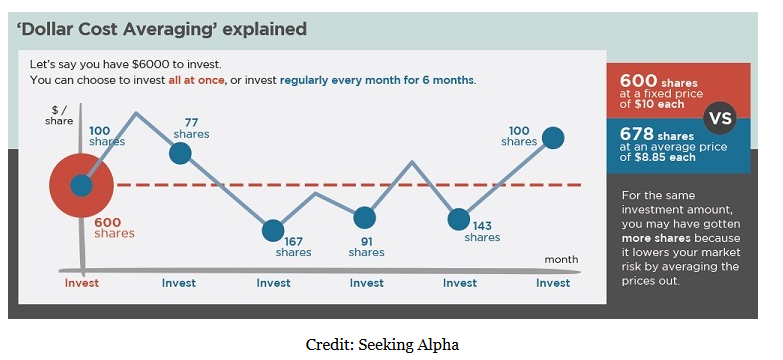

This is something that every investor should know about their portfolio. While it is easy to find out and know this number, very few investors have a good sense of what their portfolio income might be. This is a low hanging fruit that again may help investors stay the course when equity markets sell-off. For clients in the retirement phase, knowing this one fact may help delay the impulse to sell any stocks as they sell-off in a drawdown. Alternatively, for clients who are still accumulating wealth and assets, knowing this information is helpful because they can then see at what rate they are able to reinvest dividends as prices move lower. Doing so is both something that can be controlled and also that can assist an investor to recover faster from a drawdown as reinvesting dividends at lower prices naturally produces the benefits of dollar-cost averaging.

Item 3: Review financial plans regularly

The third thing that everyone can and should be doing as a regular exercise is conducting a review of financial plans. This means making updates for your situation and plans as they change and ensuring that the assumptions remain valid. Financial plans are useful tools that should be used as a living, breathing, document that can guide other controllable things like spending.

When an investor sits to discuss financial plans with their advisor they should go through a Monte Carlo simulation exercise that stress test their portfolios and that bakes in events like Coronavirus which can lead to abnormal levels of volatility.

Most plans will change only slightly year to year as assumptions and asset values change, but knowing the probability of success as those changes occur is very helpful for peace of mind. Another thing that can be controlled as it relates to financial plans is the assumptions being used and whether those same assumptions are integrated with investment portfolios. At Avidian Wealth Management, that is the approach we take and would argue that all advisors and clients should use an integrated set of assumptions. This not only makes the financial plan more reliable but can help an investor select the correct portfolio asset allocation and risk profile based on the plan.

[/toggle]

KHOU 11 News Interview: Coronavirus: Have a plan to protect your investments

“An Avidian Wealth Management financial adviser said the unknown is fueling the roller coaster we’re seeing on the stock market.”

Published: 10:09 PM CDT March 12, 2020

Click Here to Watch the Full Interview Featuring Luke Patterson, CEO of Avidian Wealth Management

Written by Scott Bishop, MBA, CPA/PFS, CFP®

Over the years, I have written many articles on financial planning. Several of those have been “guides” to help readers through different stages of their life or lifecycle events. Two of those were the Retirement Survival Guide and Layoff Survival Guide.

Click Here to Read our Full Recession Survival Guide Article

IMPORTANT DISCLOSURES

Financial Planning and Investment Advice offered through Avidian Wealth Management (STA), a registered investment advisor. STA does not provide tax or legal advice and the information presented here is not specific to any individual’s personal circumstances. To the extent that this material concerns tax matters or legal issues, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice. Use only at your own peril. As always, a copy of our current written disclosure statement discussing our services and fees continues to be available for your review upon request.

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*