Published on: 07/02/2020 • 9 min read

Avidian Report – The Challenges we see in Fixed Income Today

INSIDE THIS EDITION:

The Challenges we see in Fixed Income Today

Weekly Global Asset Class Performance

Coronavirus / COVID-19 Resource Center

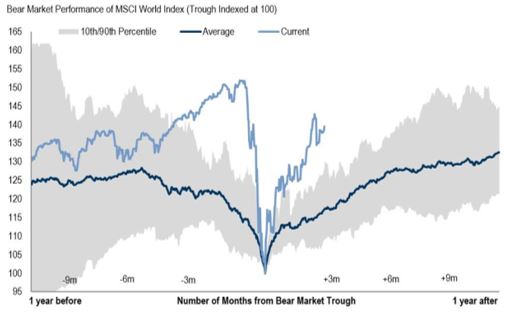

The S&P 500 recorded the fastest peak to bear market decline and the fastest bear market exit ever. In fact, it only took 23 trading days for the market to go from peak to trough and only 17 days for the market to make back 50% of what it lost. Historically, once 50% of a drawdown is regained, markets rarely go on to revisit the previous lows.

[toggle title=’Read More’]

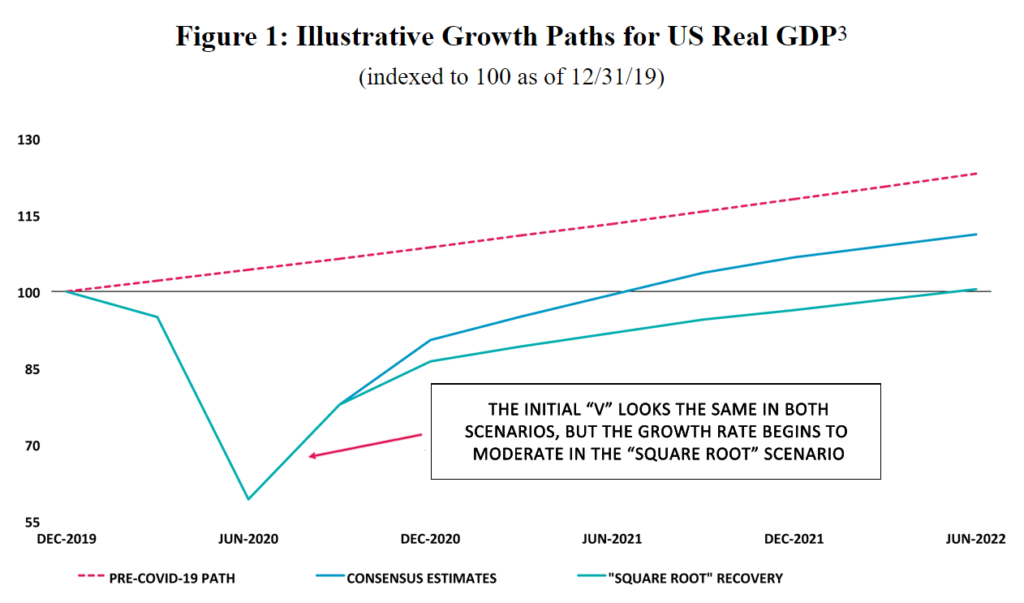

This time around, there are three drivers that have primarily been responsible for returns and volatility this year—the infection curve, the policy response, and hope about a v-shaped recovery. From where we sit, we don’t believe returns will be made at the rate we have had off of the lows.

Instead, we think the path will coincide with the shape of the economic recovery. As most investors know at this point, we started with a sharp slump in the 2nd quarter of 2020 as COVID-19 brought the US economy to a virtual standstill. As we move into the second half of the year however, we see some improvement ahead as we get a bump led by industries that can function unabated despite social distancing measures. This includes some areas of manufacturing and construction. In fact, we think this is the strongest part of the recovery given the hard shutdown we saw during the second quarter of the year. We think this improvement will slow into 2021 as we potentially see several segments of the economy that may struggle to operate profitably if social distancing protocols remain in place. This may include restaurants, brick and mortar retail, air travel, hotels, and sporting events. Unfortunately, this flatter glide path to recovery may continue until such time that a vaccine or treatment for COVID-19 is found, at which time we expect pent up demand to lead to a surge back toward pre-COVID-19 levels.

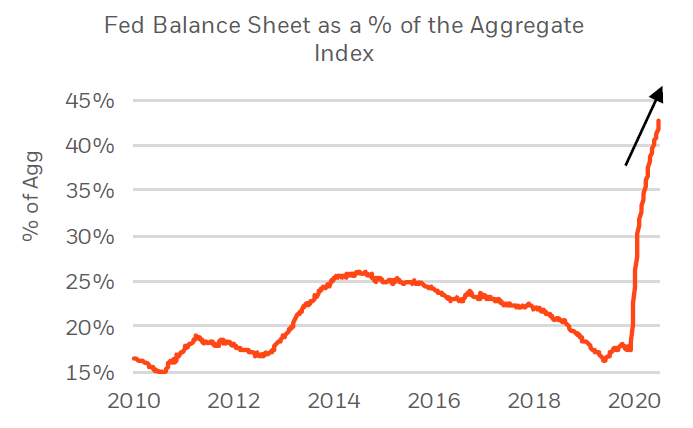

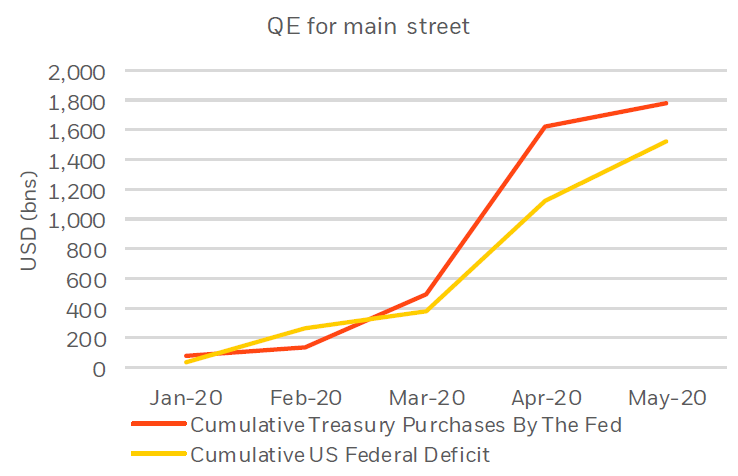

Without a doubt what we are currently witnessing is a disconnect between market performance and what the economic data is telling us. Truthfully, we think many investors have simply underestimated the magnitude and speed of both monetary and fiscal policy support. For some context we can look at some numbers that really tell the story of how unprecedented policy action has been. Take for example that throughout the history of the Fed until 2008, which is roughly 90 years, the Fed’s balance sheet grew from ~$0 to ~$900 billion. It then took the Fed 6 years, from 2008 through 2014, to grow the Fed balance sheet four-fold, to nearly $4.5 trillion. Yet, even that pales in comparison to the fact that it only took 3 months, from March to June, to further grow its balance sheet from under $4 trillion to over $7 trillion. Add to that that it only took a few weeks for congress to pass a $2.4 trillion fiscal package which dwarfed the aggregate fiscal stimulus we saw in the aftermath of financial crisis.

Recent policy action in fact has seen the Fed purchase approximately 10% of the US Barclays Aggregate Bond Index which is large by any standard. Yet, some economists estimate that the Fed Balance Sheet could balloon by another $4 trillion by the end of the year. If this happens, the Fed could end up purchasing nearly 20% of the US Barclays Aggregate Bond Index and the equivalent of 28% of the S&P 500‘s market cap, or nearly 1/3 of US GDP. Clearly, the amount is huge and represents a $1.5 trillion direct transfer of printed money from the Fed to the Treasury which then goes to the private sector. If you do some more math, these massive cash injections are the equivalent to average household income being about 31% higher for 2020 than it was just before the pandemic, despite surging unemployment.

Of course, this new phase of policy support has major implications for investors especially in fixed income. First, we are likely to see this low interest rate environment continue for an extended period of time which also means that getting extra yield by extending duration will be increasingly difficult as the yield curve will likely be flatter than it has been in the past. Second, we are likely to see large-scale debt monetization, explicit yield curve control, and zero or negative rates that could drastically alter the ability of investors to capture stability, yield, and diversification at the same time.

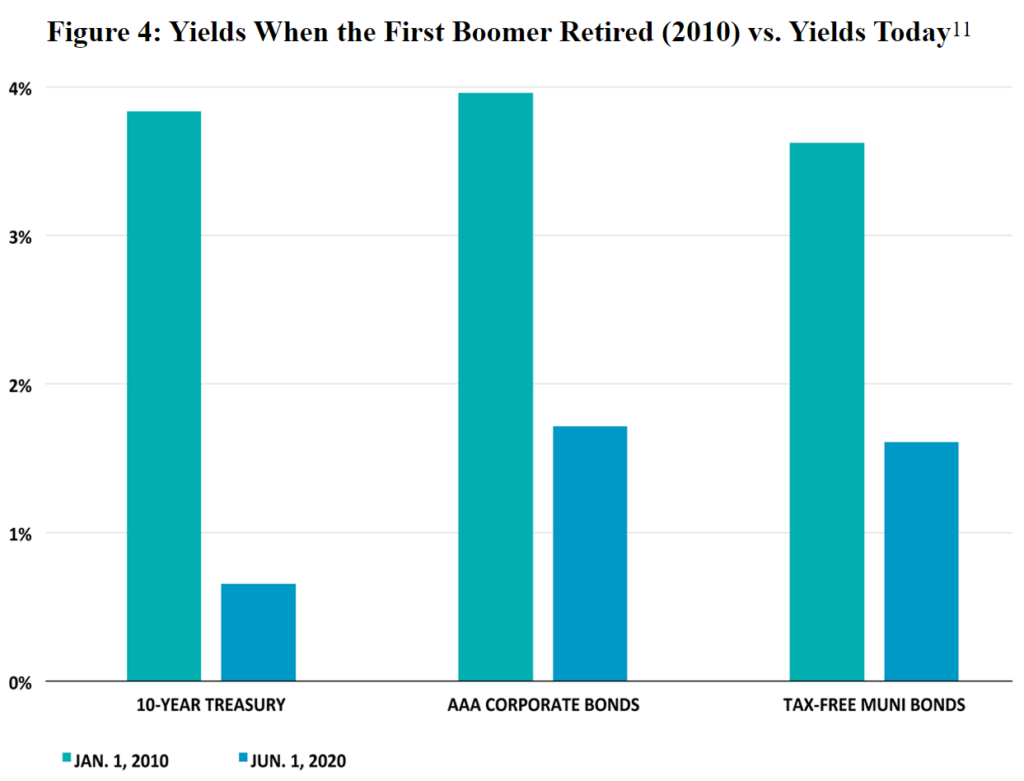

As a result, there will be tremendous challenges in front of baby boomer investors who are seeking reliable and targeted levels of income. When the first boomer retired in 2010, they could get 4% yield from high-quality fixed income assets such as US Treasury, AAA corporate bonds, and tax-free muni bonds. Today, the yields that can be earned in similar fixed income assets are mere fractions of what they were in 2010.

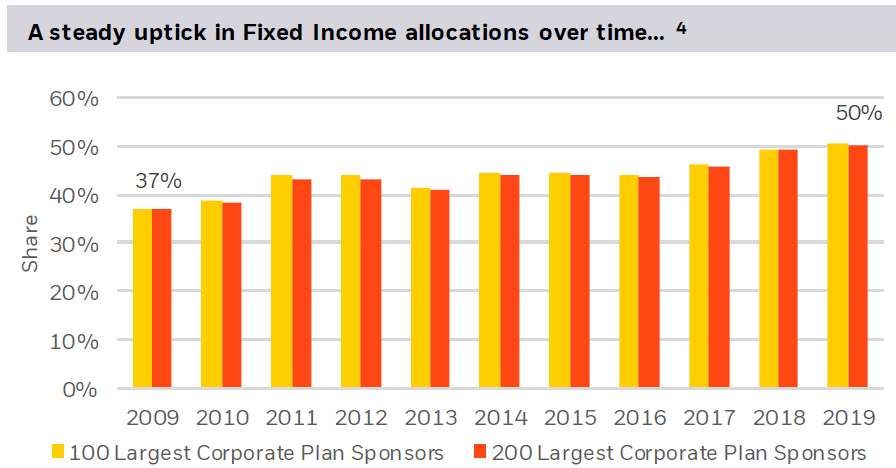

The combination of low interest rates and increased allocations to fixed income in the last decade also worsened the underfunding status of many public and private pension plans. From an investment perspective, we expect institutional investors will have to tolerate higher risks to meet their future obligations.

Unfortunately, for retirees, the challenges go beyond just the income they can generate from fixed income. They also face challenges in getting the stability they demand from fixed income assets. This is different from the past.

Take for instance the real yield on a 10-year treasury note. As you can see on the grey line in the chart below, it is negative. This means that expected returns from risk-free assets, including CD’s, Money Markets, Treasury Bills and bonds, will no longer be able to beat inflation. As a result, investors must take meaningful risks to preserve wealth and the low volatility and positive nominal return seen in fixed income provide only a false sense security.

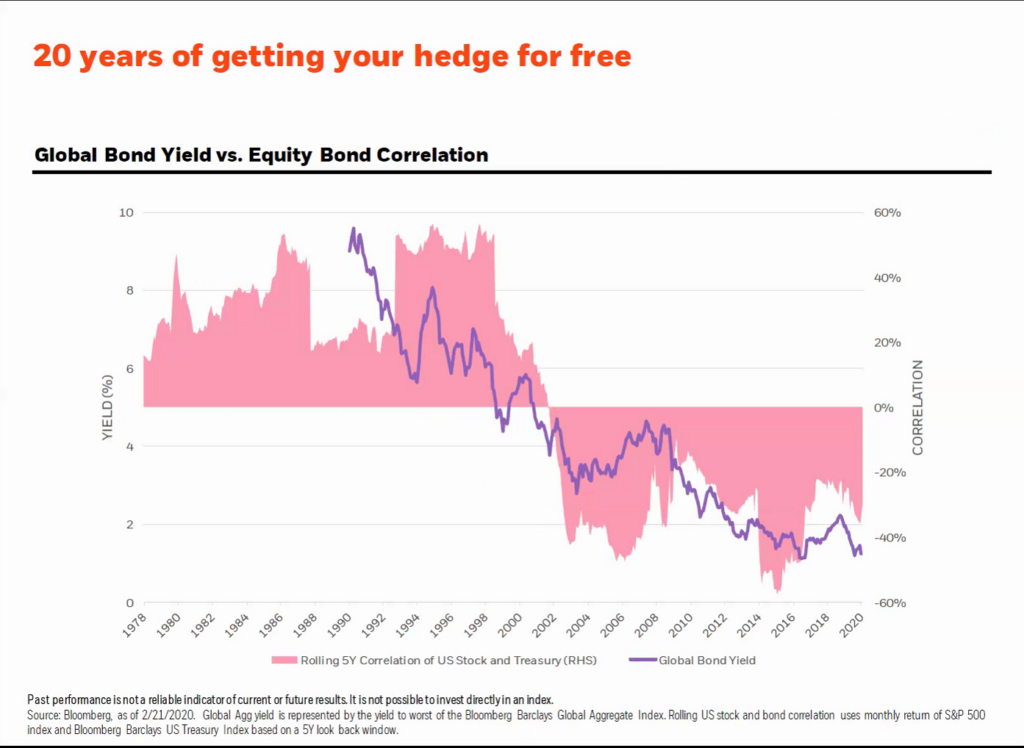

The third challenge is that high quality bonds used as a portfolio hedge are expensive and only provide limited effectiveness. Take longer-dated bonds, which have delivered strong total returns in last three decades. The white line is the cumulative total return of the S&P 500 Index. The red line is the total return of TLT, the iShares 20+ year treasury ETF. Many investors often cheer the double-digit annual returns they have gotten from stocks since 2008, but few know that boring extra-long treasury bonds delivered the same amount of returns but with much lower volatility.

Additionally, they did so while providing negative correlation when the stock market dipped. In other words, in the last 20 years, investors were getting paid to own portfolio insurance by having duration in the portfolio.

In an extremely low-interest-rate environment, bonds cannot simultaneously satisfy investors’ need for stability, income, and diversification. Some tradeoffs must be made. However, we would argue that stability and diversification are less desirable for a bond-heavy portfolio because the portfolio tends to have low volatility, to begin with, due to light or no exposure to stocks. If income targets are beyond what can be delivered via a traditional bond portfolio, we offer a few solutions.

First, an investor might own middle-quality yield assets like investment grade corporates, high yield, emerging market debt, or preferred securities. This might extend the credit quality a bit but care sector and security selection might help still pick up incremental yield in a semi-conservative fashion. We also might suggest layering in some alternative assets like core real estate or core infrastructure that often exhibit less sensitivity to the business cycle. The third approach would be to step out even further on the risk spectrum by adding some equity income strategy exposure as this can help drive income, but still offer necessary liquidity. In the end however, how an investor builds their fixed income sleeve is largely determined by the holistic mix of assets in the portfolio.

Weekly Global Asset Class Performance

[/toggle]

Over the last several weeks, the team at Avidian Wealth has attempted to keep our clients apprised of updates related to the markets, economy, government, tax, retirement, and other changes impacting us during this difficult time. As the Coronavirus (COVID-19) pandemic continues to spread, its impact on businesses and individuals has been significant. Stay up-to-date on the latest news with this Coronavirus Resource Center as your go-to resource for commentary, news, and other resources. Bookmark this article to check back regularly for updates.

Click Here to Explore the COVID-19 Resource Center

Disclaimer:

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Avidian Wealth Solutions), or any non-investment related content, referred to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Avidian Wealth Solutions. Please remember to contact Avidian Wealth Solutions, in writing, if there are any changes in your personal/financial situation or investment objectives to review/evaluating/revising our previous recommendations and/or services. Avidian Wealth Solutions is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Avidian Wealth Solutions’s current written disclosure statement discussing our advisory services and fees continues to remain available upon request.

Financial Planning and Investment Advice offered through Avidian Wealth Management (STA), a registered investment advisor. STA does not provide tax or legal advice and the information presented here is not specific to any individual’s circumstances. To the extent that this material concerns tax matters or legal issues, it is not intended or written to be used, and cannot be used, by a taxpayer to avoid penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*