Published on: 08/09/2023 • 6 min read

Are There Cracks Emerging in the Labor Markets?

After a very challenging year for investors in 2022, the first half of 2023 saw considerable improvement across asset classes as the U.S. economy remained surprisingly resilient despite some concern over the health of regional banks. The first half of 2023 marked the start of a potential inflection point for the world economy, and while the United States economy remains relatively strong, some initial cracks appear beneath the surface of labor markets.

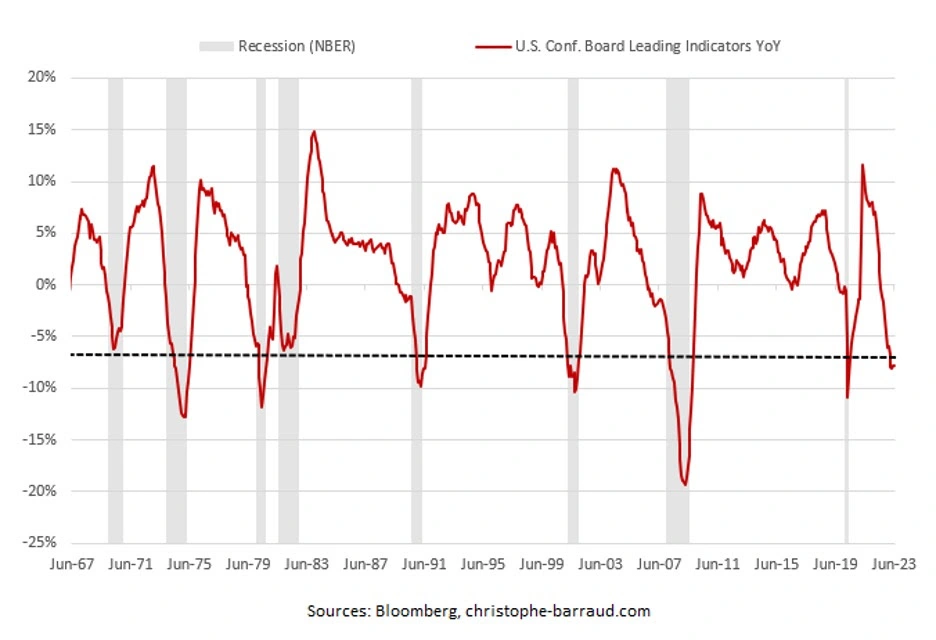

Take, for example, the US Conference Board’s Index of Leading Indicators. When we look at the YoY change, leading indicators are down considerably. In fact, as the Bloomberg signs chart below shows, anytime the red line has converged upon the horizontal dotted line as it has most recently, we have either been in recession or very close to one.

While the US economy’s current condition may not be as dire as the leading indicators suggest, it is still worth noting that labor markets are not in great shape. Here’s what you need to know.

The labor market explained

A labor market is a place where the supply and demand of workers, employers, and job opportunities meet. The labor market is always in flux, with new jobs being created while others become obsolete. It affects not only economic growth but also the way people live their lives and the decisions made by governments.

What are the different labor markets? When talking about labor markets, we can refer to two different levels. At the macroeconomic level, the labor market refers to the labor supply and demand of an entire nation or region. On the individual level, it refers to the labor supply and demand of particular sectors or industries.

It should also be noted that the connection between labor markets and inflation is an important one. When there are more workers available than jobs, wages tend to decrease as employers have the bargaining power to pay less. This leads to lower levels of consumer spending and can result in deflationary pressures. On the other hand, when there is a shortage of workers, employers must pay higher wages in order to compete for talent, which can lead to inflationary pressures in the economy.

Learn more about small business inflation

What are 5 factors that affect the labor market?

The labor market is an important piece to consider when assessing the economic health of any given country. While there are some signs that suggest cracks beneath the surface (or whether we’ll end the year in a bullish vs bearish market), it’s too early to tell how long-term economic growth will be affected. As such, it’s important to keep an eye on labor markets in order to get a better understanding of what’s happening — and more importantly, to try to predict what will be happening — with the economy.

The US Bureau of Labor Statistics has identified five key factors that affect the labor market:

- Unemployment rate: This is the number of people who are actively seeking work but are not able to find any. A higher unemployment rate indicates a weaker labor market and can lead to deflationary pressure on wages.

- GDP growth: When the economy grows, businesses usually expand their operations and create more jobs. This leads to an increase in job opportunities and stronger labor markets.

- Automation: Automation has been a major factor in replacing human labor with machines, increasing productivity but decreasing the demand for workers. This can have an adverse effect on the labor market.

- Education and training: The quality of education and skills training affects the number of qualified workers available in the labor market as well as their wage rate.

- Government policies: Governments often implement policies designed to promote economic growth and create jobs, such as tax incentives, investment in infrastructure, and labor regulations. These can have a positive or negative effect on the labor market depending on their implementation.

Is it a tight labor market right now?

The tightness of the labor market can be measured by analyzing various factors such as the unemployment rate, labor force participation rate, job openings, and wage growth. Generally speaking, a “tight” labor market is one in which there are more jobs than people to fill them. Currently, the US labor market appears to be fairly tight, while also showing signs of slippage.

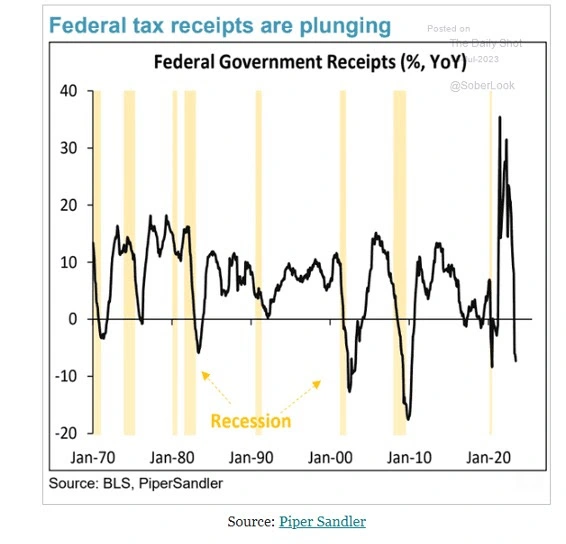

Additionally, federal tax receipts are showing trends similar to what we saw in the indicators from the chart above. As the chart below indicates, this most recent decline looks recessionary. Here, you can see a sharp decline as of late.

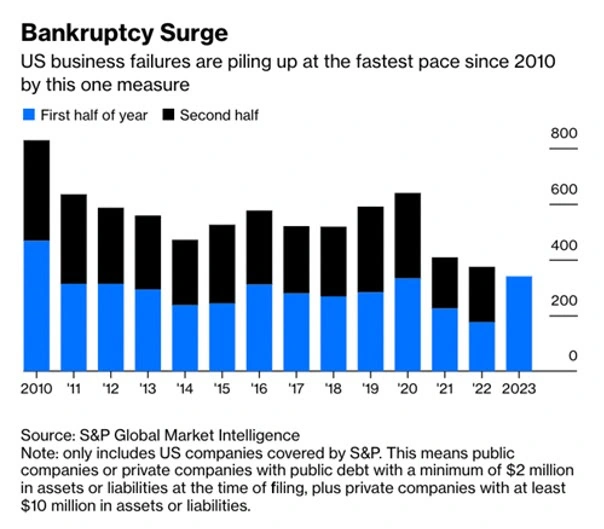

Not only that, but we are also seeing a surge in US business failures. The chart below illustrates that the first half of 2023 has seen the most bankruptcies in the front half of a year since 2010.

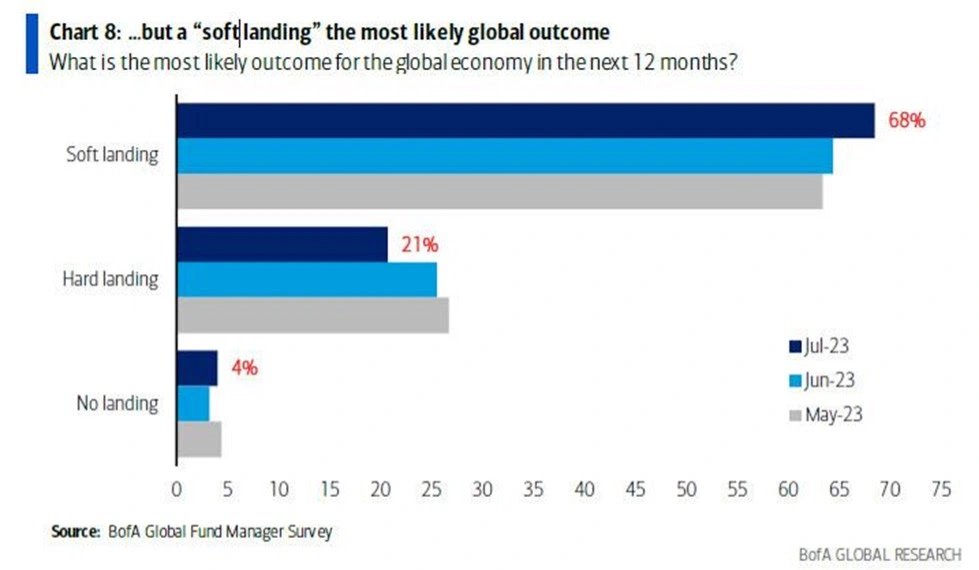

If this continues, could it signal a weaker labor market ahead and a reduction in consumer spending? Possibly, but for now, this is the non-consensus view. After all, we have 68% of fund managers surveyed by Bank of America this month expecting an economic soft-landing.

However, investors must consider what happens to markets if the consensus is wrong. We don’t necessarily see something catastrophic in that scenario, but we do believe that it sets the stage for a shift in market sentiment, one which could unleash some episodic market volatility in the months and quarters ahead.

Have questions about your financial outlook? Let’s talk.

Because the markets can be so unpredictable it can be difficult to know what steps to take to prepare yourself. If you have questions about your financial outlook or how current market conditions might affect your investments, please don’t hesitate to schedule a conversation with one of the experienced advisors at Avidian Wealth Solutions.

We are trusted fiduciaries in Houston, Austin, The Woodlands, and Sugar Land offering high-net-worth individuals high-net-worth strategies to match, ranging from planning for retirement to assessing the risks of entrepreneurship. With our comprehensive services, we can help you make the best decisions for your financial goals. Get started by contacting us online today!

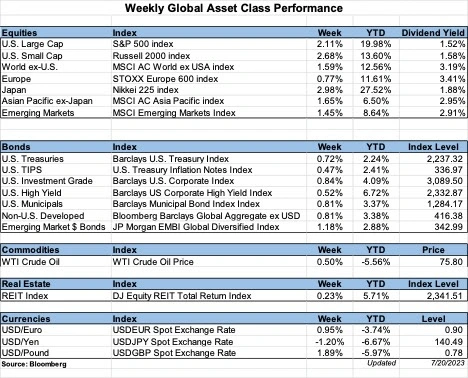

Weekly global asset performance

More Helpful Articles by Avidian:

- Navigating Economic Outlooks in 2023: What to Expect

- What Are Fixed Income Investments?

- Warning Signs of a Bad Financial Advisor

- Are Bonds a Good Investment Right Now?

- How To Protect Assets for Your Aging Parents

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*