Published on: 07/26/2023 • 6 min read

What is the Outlook for Small Caps Stocks in 2023?

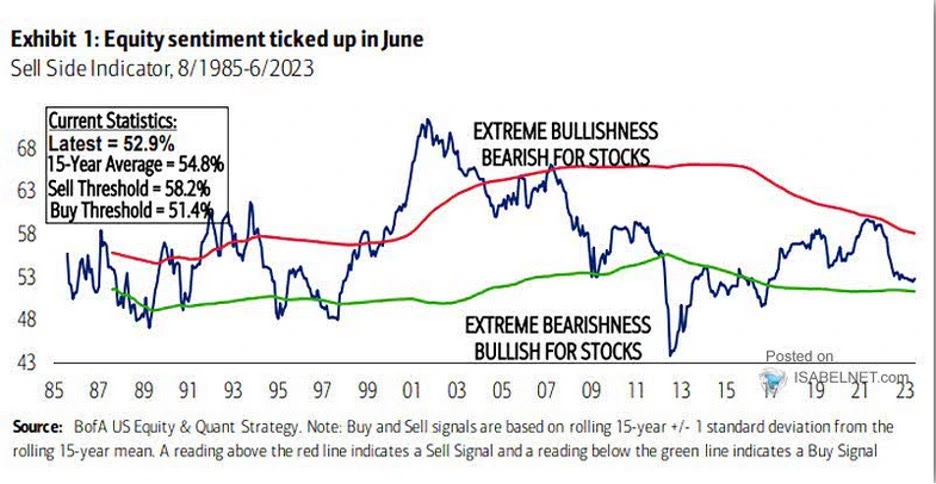

Because only a handful of stocks have pushed the broader stock market higher, investor attention has understandably been zeroed in on the strength of large-cap technology stocks, and taken the attention away from small cap predictions. This has helped improve investor sentiment toward equities, as seen in the chart below.

However, in doing so, investors have seemed to have become more weary of the future of small cap stocks. So, what does the outlook for small cap stocks look like for the rest of 2023?

What is a small cap stock?

Before we can provide insights into small cap outlooks, it’s important to understand what a small cap stock is. A small cap stock is one that has a market capitalization—the total value of its outstanding shares—of $300 million or less. Small caps generally have higher growth potential than larger, more mature companies, but they also tend to come with more risk.*

This is because the small companies that make up the majority of the small cap index tend to be earlier-stage businesses with stronger growth potential, but also greater risk than their large-cap counterparts. As a result, these stocks can offer investors higher returns over time if they are able to weather any economic downturns.

Keep reading about the risks of investing in bullish vs. bearish markets

Why invest in small cap stocks?

Small cap stocks can provide investors with the potential for market-beating returns over time. This is because smaller companies tend to have higher growth rates than their larger counterparts, as they often operate in more niche markets or are early adopters of new technologies.

Additionally, small caps offer investors a chance to invest in companies that may not yet be well-known or widely covered by analysts. This can provide investors with the potential for discovering companies that have yet to be fully valued by the market, offering a unique opportunity to get in early on a potentially lucrative investment. Although this is also what makes them a more risky investment.

Finally, small cap stocks can be an effective way of diversifying an investment portfolio and complementing alternative investing strategies. Many small caps are often more insulated from the broader economic cycle than their large-cap counterparts, and can therefore may offer protection against a potential market downturn.

What is the outlook for small cap stocks?

We think that despite the improved market sentiment, investors have completely forgotten about small-cap stocks. Unsurprising to us when we consider that small-cap stocks are often thought of as being less widely followed and poorer performers heading into a recession. Further, as we have seen over time, small caps tend to be more volatile when compared to large and mega-cap stocks represented by the S&P 500.

However, we believe investors shouldn’t write them off entirely just yet. In fact, there may be some compelling reasons to include them as part of a diversified equity portfolio. Here’s why:

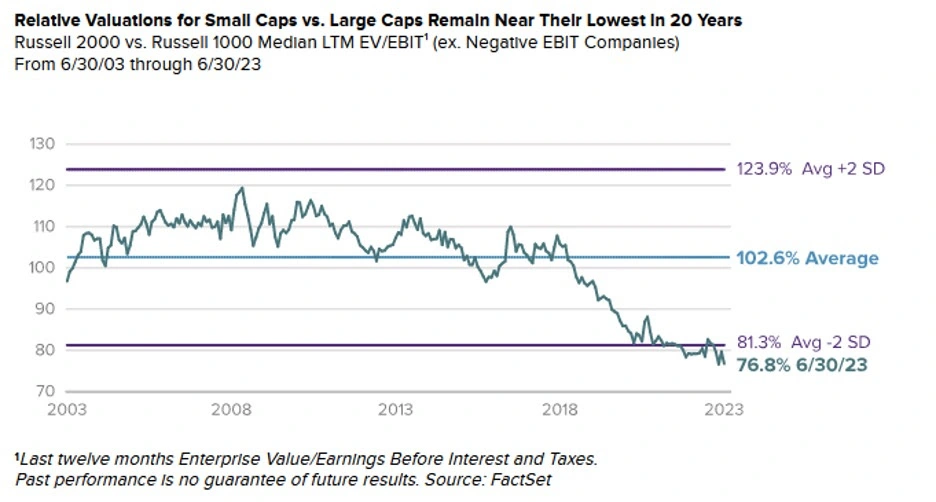

1. Currently low valuations

For one, we are seeing valuations for small caps versus their large-cap peers near 20-year lows. In fact, as the chart below shows, valuations on a EV/EBIT multiple basis are experiencing a more than two standard deviation discount, with the Russell 2000 small cap index trading at nearly a 25% discount vs. the Russell 1000 median.

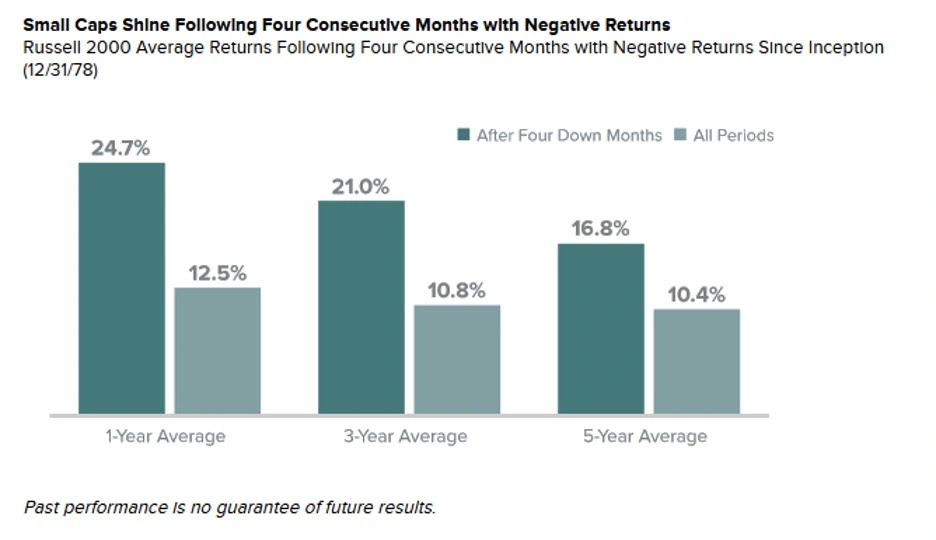

2. Consecutive months of negative returns

February to May of this year saw the Russell 2000 small cap index post four consecutive months of negative returns. While counterintuitive, history has shown that small caps tend to perform well on average after four consecutive months of negative returns. Most notably when we look over longer time horizons.

The chart below looks at one-, three-, and five-year average returns for the Russell 2000. We see that small caps not only shine over longer time horizons, but they have historically produced better performance on average in periods that follow four consecutive months of negative performance.

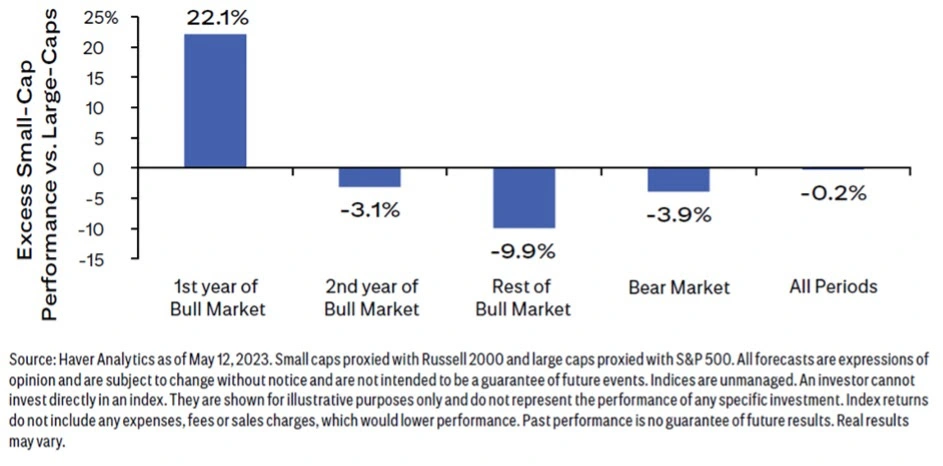

3. Historical excess performance when coming out of a recession

As the chart below shows, small caps typically lead the way into a new bull market. While we are not saying we can perfectly time the market, we are saying that in our view, there is an equal chance we get an economic soft landing as there is we get a recession.

Weekly global asset class performance

Thinking about diversifying your portfolio with small cap stocks? Let’s talk.

If a soft landing happens, could small-cap stocks perform like we are coming out of recession and starting a new bull run? We certainly think it is possible.

If you have more questions about the outlook for small cap stocks in the rest of 2023, are wondering how selling your stocks would impact your federal income tax in Texas, or want to learn more about how small cap stocks could complement your portfolio, don’t hesitate to schedule a conversation with us today.

With physical offices in Houston, Austin, Sugarland, and The Woodlands each offering investment management services, we are here to help you understand whether or not3 your managed accounts are well-positioned for this potentially challenging environment.

More Helpful Articles by Avidian:

- Navigating Economic Outlooks in 2023: What to Expect

- What are Fixed Income Investments?

- How to Transfer House Title After Death in Texas

- How to Tell if Your Financial Advisor Is Bad

- Are Bonds a Good Investment Today?

Please read important disclosures here

Get Avidian's free market report in your inbox

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*