Published on: 06/22/2023 • 6 min read

Navigating Economic Outlooks in 2023: What to Expect

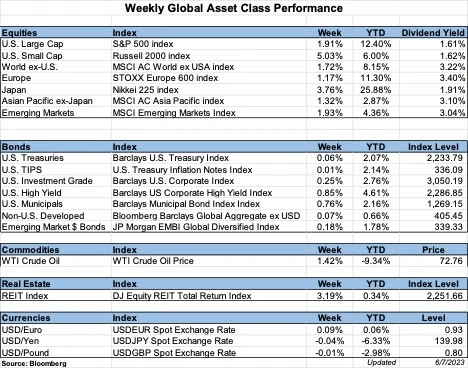

Thus far In 2023 the global economy has shown strong and steady growth, surpassing expectations in various sectors and giving cause for optimism among many investors. Factors such as lower commodity prices, robust consumer spending, and thriving service industries have played a significant role in driving this positive trend. As a result, many investors have become optimistic and are no longer actively considering the possibility of a recession.

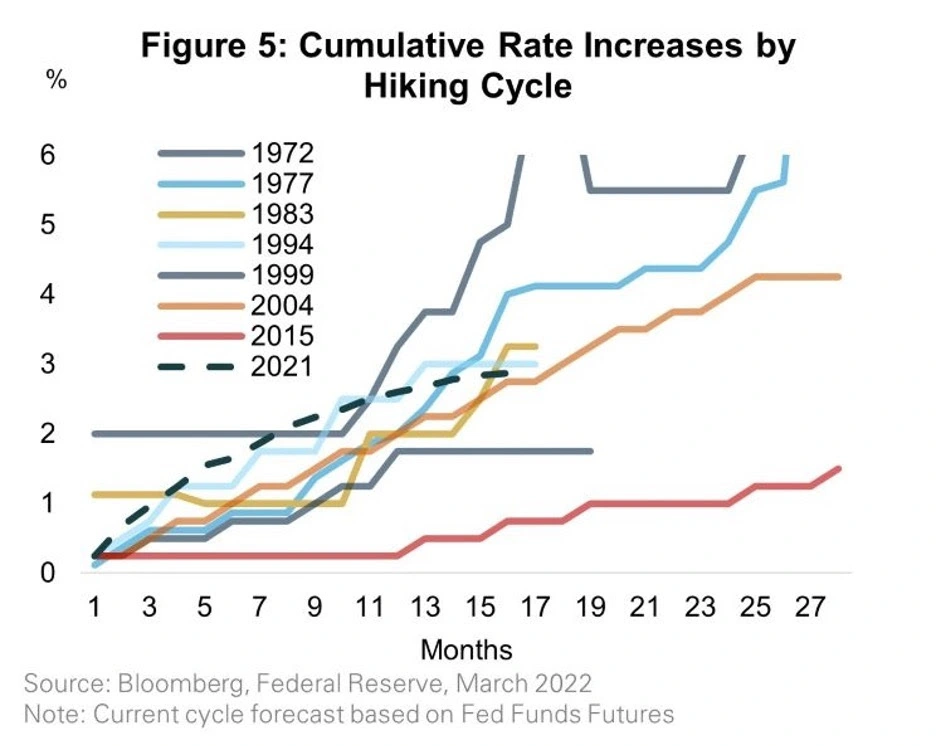

We believe, however, that this economic momentum may not be sustainable. This is especially true as we consider that the impact of monetary tightening usually works with a lag, meaning that the threats to economic expansion may build in the coming quarters as the economy reflects a higher terminal interest rate.

What does this mean and how can investors be prepared? Keep reading to find out.

What are the threats to the US economy?

As we assess the data, we believe that economic threats are a possibility in several areas, including:

- Stubborn inflation that will keep interest rates higher for longer

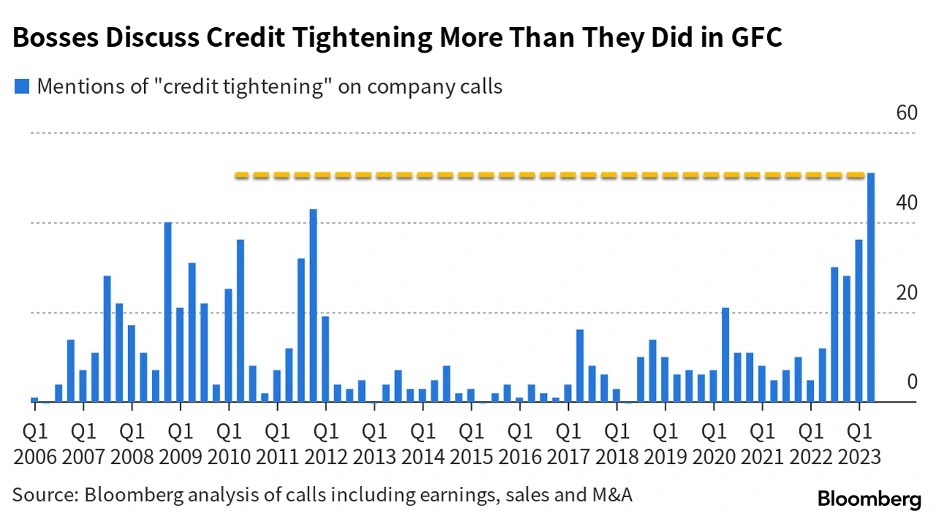

- Further tightening in credit availability because of banking concerns

- Softening labor market

- An erosion of consumer excess savings

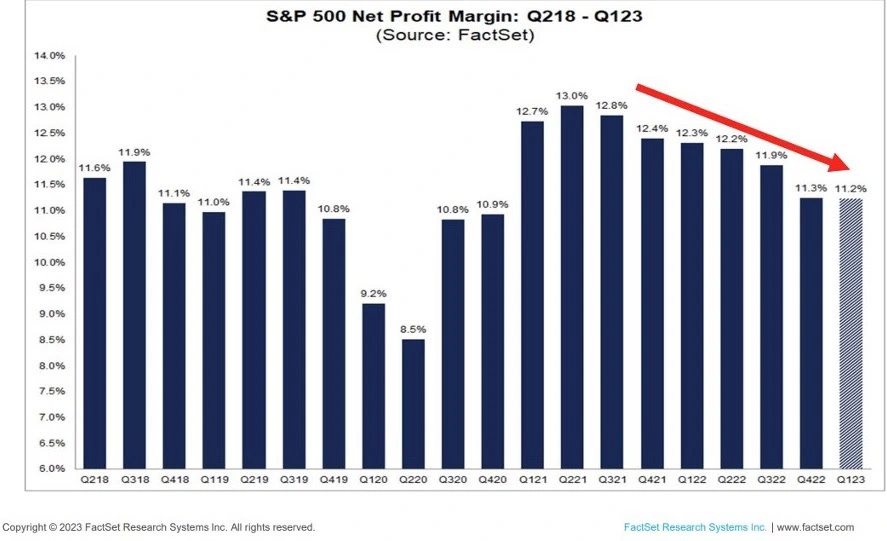

- Compression in corporate profit margins

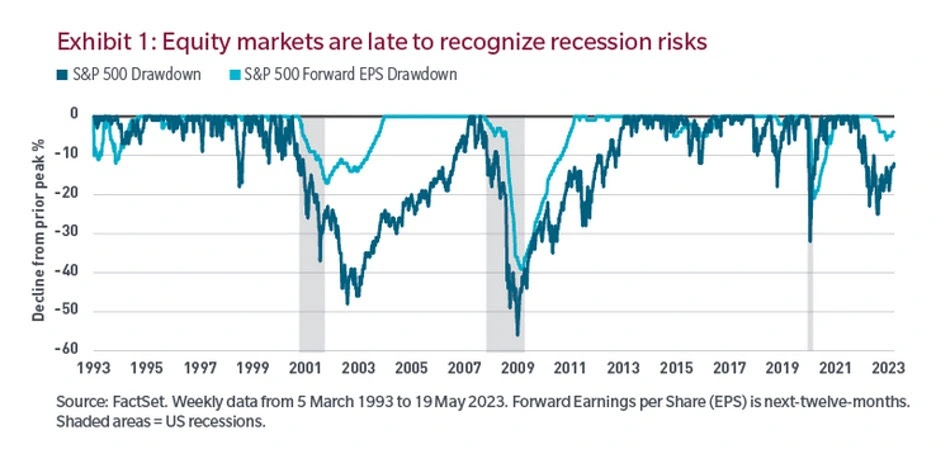

With so many investors seemingly ignoring these threats, risk management in portfolios is currently of utmost importance, as a strongly inverted yield curve, like we have today, is sending a recession signal. Furthermore, we believe there are many other indicators and still-developing data points that will bear watching as we head into the remainder of the year.

What indicators should investors be watching?

When it comes to predicting a recession, investors should pay attention to indicators such as:

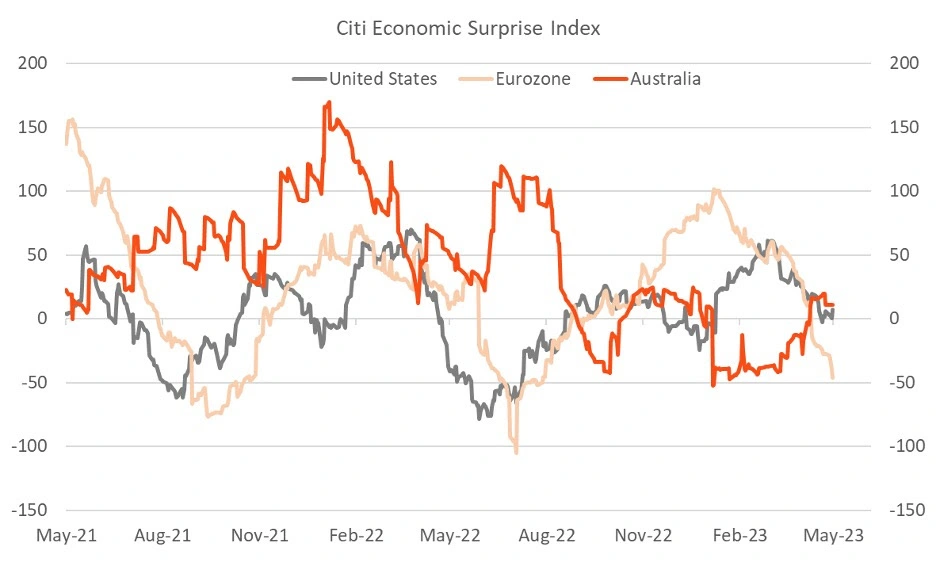

1. Economic growth

Growth has been resilient, but the odds of a deceleration remain elevated. Recently, the Citigroup Economic Surprise Index across the US, Europe, and China are moving down, pointing to slowing growth momentum. Long and variable lags in monetary policy are expected to slow the economy, but for now data remains mixed.

2. Inflation

Inflation is likely to continue to moderate as the economy slows, but it may take a while to reach the Fed’s 2% target. As such, bond yields might not need to reprice much higher from here. Disinflation initially helps equity valuation multiples, but further down the line it could pressure corporate profitability through waning pricing power.

Keep reading: How does inflation affect small businesses?

3. Monetary policy

The Fed is likely approaching the end of the rate hiking cycle as a result of debt ceiling concerns. However, given the stickier nature of inflation, rates are likely to stay higher for longer. Without obvious signs of distress and pain in the real economy or financial markets, the Fed is unlikely to make a dovish pivot.

4. Liquidity

Most recently, the Fed’s balance sheet expanded substantially as banks borrowed heavily from its discount lending facility. In fact, more than half of the Fed’s balance sheet reduction since last year has been unwound. This mini-QE has supported the market so far in the second quarter.

However, the Fed remains steadfast in its goal of withdrawing excess liquidity from the system. As such, it would not surprise us to see central bank balance sheets contract rapidly. Excess liquidity drove rising asset prices throughout this cycle, and draining that liquidity could do the opposite to asset prices.

5. Corporate earnings

Over the past two years, corporate earnings have been very resilient, as pent-up solid demand has allowed companies to pass rising input costs on to consumers. The market consensus now expects EPS to remain flat this year before rising 11% in 2024. This may prove overly optimistic, as profit margins are at risk and softer earnings ahead.

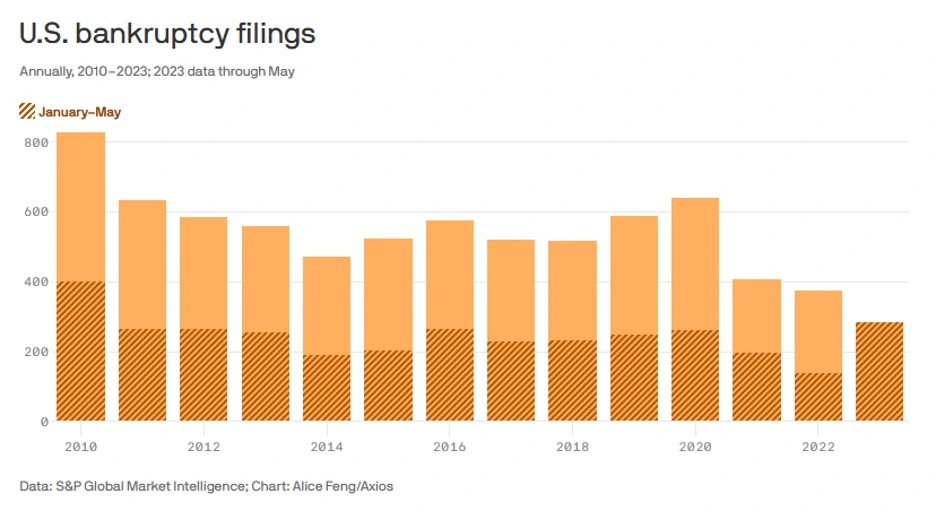

6. Corporate solvency

US bankruptcy filings are at their highest level since 2010. While the credit cycle remains benign, highly leveraged companies face a wall of debt maturities in the coming years. With the amount of debt that needs to be financed increasing each year from 2024 to 2027, we could see some headwinds for less well-capitalized businesses.

7. Market breadth

Internal market leadership has been extremely narrow to date. In fact, all S&P 500 sectors, apart from tech-related sectors and AI-related names, are flat to down on the year. While we have gradually become more positive on tech this year due to bond* yields approaching their expected terminal level, we remain leery of performance that may run ahead of future fundamentals. As it stands, a swoon in these technology firms could spell challenges for the broader market.

*Learn more: Are bonds a good investment right now?

Concerned about your portfolio’s ability to withstand market turbulence? Let’s talk.

In short, the impressive performance of the global stock market in the first half of 2023 may fully warrant expectations for a soft landing, but it is possible that many risks that pose threats to that scenario are being ignored. As a result, we see a possible scenario in which stocks may have trouble matching the gains of the first half of the year, and encourage investors to keep risks in mind.

If you aren’t sure if you are well positioned for this potentially challenging environment, don’t hesitate to contact the advisors at Avidian Wealth Solutions. We are a Houston-based high-net-worth wealth management firm offering tailored wealth solutions to business owners, investors, and families alike.

Schedule a conversation with us today to learn more about what we can offer you and your portfolio.

More Helpful Articles by Avidian:

- Are Bonds a Good Investment Right Now?

- Warning Signs of a Bad Financial Advisor

- How To Protect Assets for Your Aging Parents

- How To Talk to Your Advisor About Asset Allocation Strategies

- Investing in Bullish vs. Bearish Markets

Please read important disclosures here

Get Avidian's free market report in your inbox

Continue reading:

Schedule a conversation

Curious about where you stand today? Schedule a meeting with our team and put your portfolio to the test.*